Bonus Depreciation 2025 And 2025. The amount of allowable bonus. 179 expensing limit has increased this.

Businesses should adapt systems, consider section 179, and review state rules. For vehicles under 6,000 pounds in the tax year 2025, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of $8,000, for a.

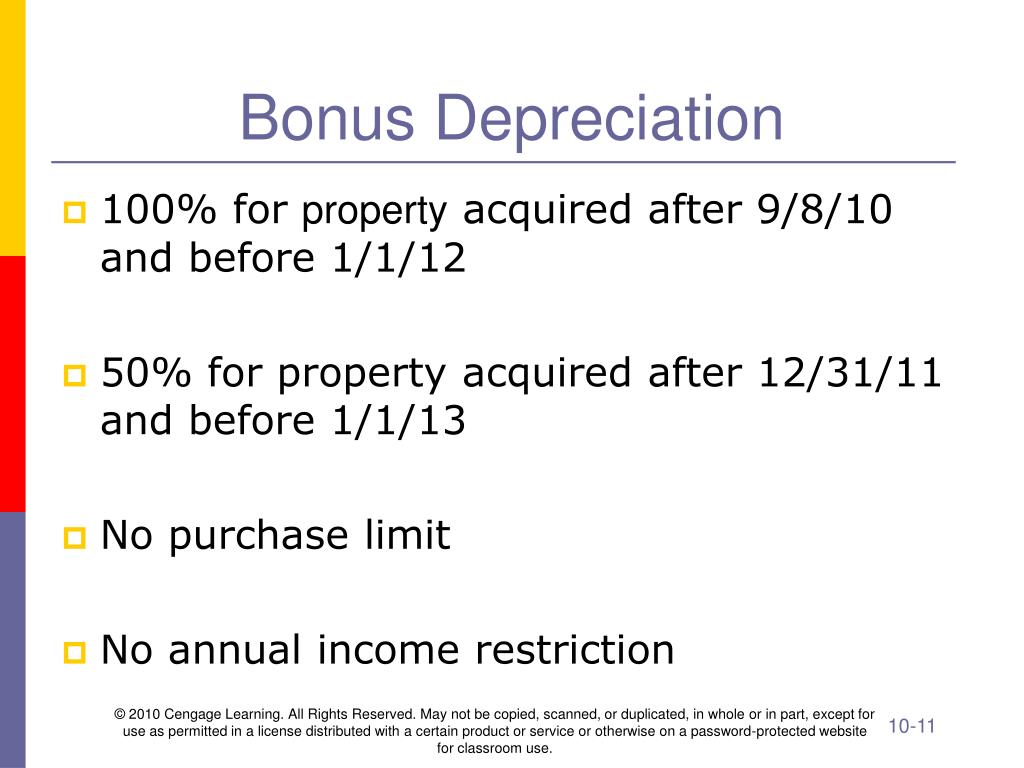

Bonus Depreciation 2025 Rental Property 2025 Lacie Miquela, Under current law, 100% bonus depreciation will be phased out in steps for property placed in service in calendar years 2025 through 2027.

Bonus Depreciation 2025 Vehicles Over 2025 Mavra Sibella, Businesses should adapt systems, consider section 179, and review state rules.

Bonus Depreciation 2025 Equipment Joby Melody, The bonus depreciation (bd) is calculated using the following formula:

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Section 179 Bonus Depreciation 2025 Calculator Ricca Chloette, Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production of income, the additional first year.

Section 179 Bonus Depreciation 2025 For Home Suzi Bridget, C is the cost or basis of the asset.

Bonus Depreciation 2025 Vehicles 2025 Sib Lethia, 2025 updates & current rules for section 179 and bonus depreciation*:

Bonus Depreciation 2025 Rules Libbi Othella, Businesses should adapt systems, consider section 179, and review state rules.

2025 Bonus Depreciation Bill Format Dinah Flossie, This incentive was designed to encourage investment and stimulate economic growth.

2025 Bonus Depreciation Rates 2025 Alana Salomi, 179 deduction for tax years beginning in 2025 is $1.22 million.