Maximum Gift Allowance 2025. Year of gift annual exclusion per donee annual exclusion total per donee (from 2 spouses) 2011 through 2012: Gifting more than this sum means you must file a federal gift tax return in 2025.

This means you can give up to $18,000 to as many people as you want in 2025 without. How much money can i gift my children?

Find out which gifts count towards the value of the estate, how to value them and work out how much inheritance.

There’s no limit on the number of individual gifts that can be made, and couples can give double.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, The annual exclusion amount for 2025 is $17,000 and for 2025 is $18,000. The faqs on this page provide details on how tax reform affects estate and gift tax.

IRS Increases Gift and Estate Tax Thresholds for 2025, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for inflation.). What is the 2025 and 2025 gift tax limit?

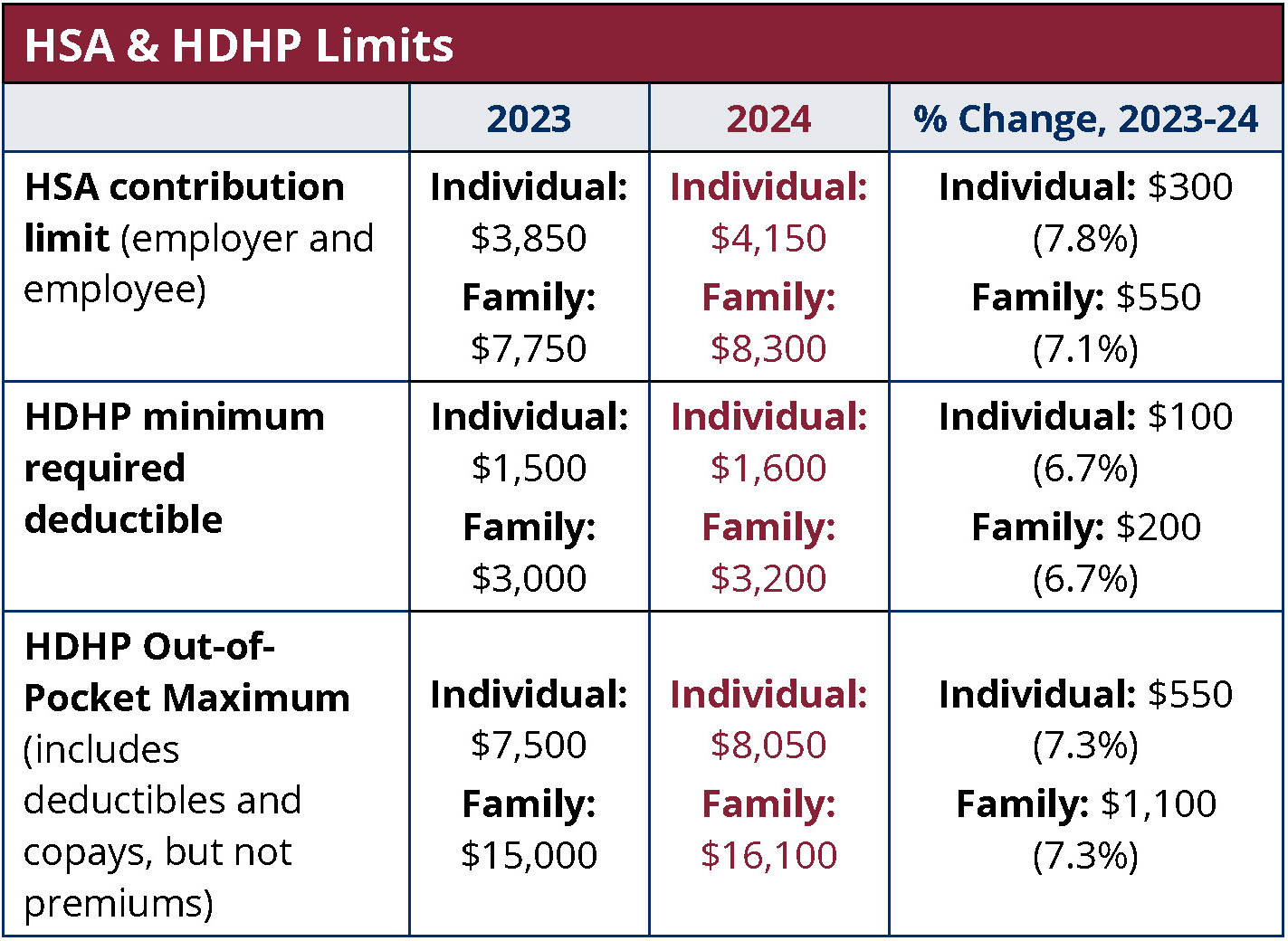

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, That’s because the irs allows you to give away up to $18,000 in 2025 and $17,000 in 2025 in money or property to as many people as you like each year. Visit the estate and gift taxes page for more comprehensive estate and gift tax information.

Federal Withholding Tables 2025 Federal Tax, Contribute early to tfsas to. Find out which gifts count towards the value of the estate, how to value them and work out how much inheritance.

Autumn Statement 2025 HMRC tax rates and allowances for 2025/24, Work out inheritance tax due on gifts. There's no limit on the number of individual gifts that can be made, and couples can give double.

W4 Allowances 2025 W4 Forms, Rent paid over 10% of salary plus dearness allowance; In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

IRS Announces 2025 HSA Contribution Limits, As per the law, as it stands today which was amended in 2017, gifts received by any person by any person or persons are taxed in the hands of the recipient under the head ‘income. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

CPF Contribution Rates 2025 All You Need To Know About the Latest, How much money can i gift my children? For 2025, the annual gift tax exemption is $18,000, up from $17,000 in 2025.

2025 Contribution Limits and Standard Deduction Announced — Day Hagan, How much money can i gift my children? This is known as your annual exemption.

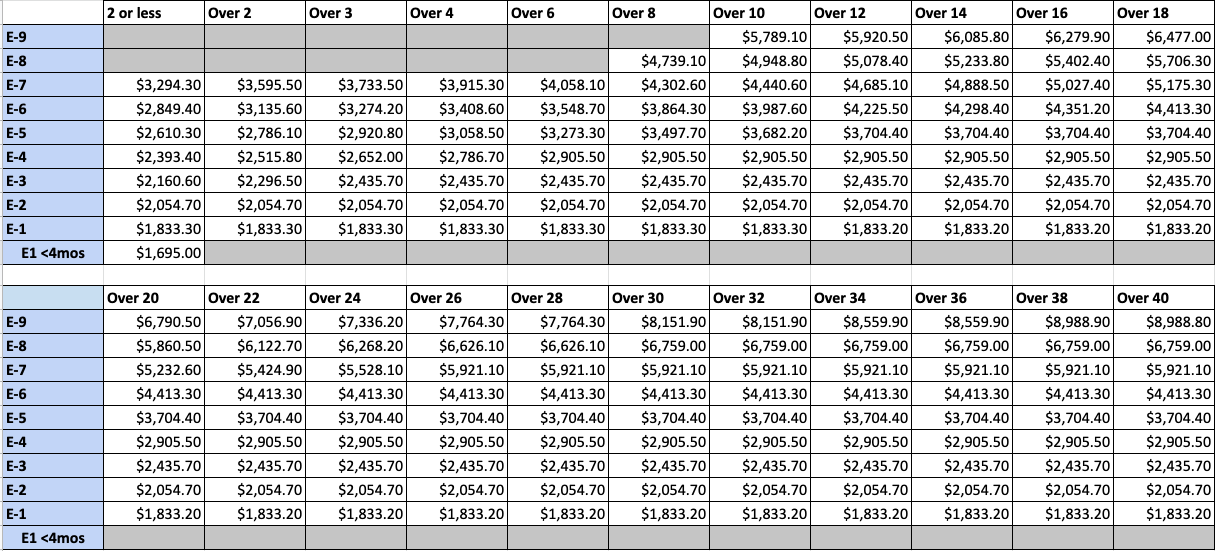

Proposed 2025 Military Pay Chart, For 2025, the annual gift tax exemption is $18,000, up from $17,000 in 2025. These gifts can include cash as well as other.

In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).