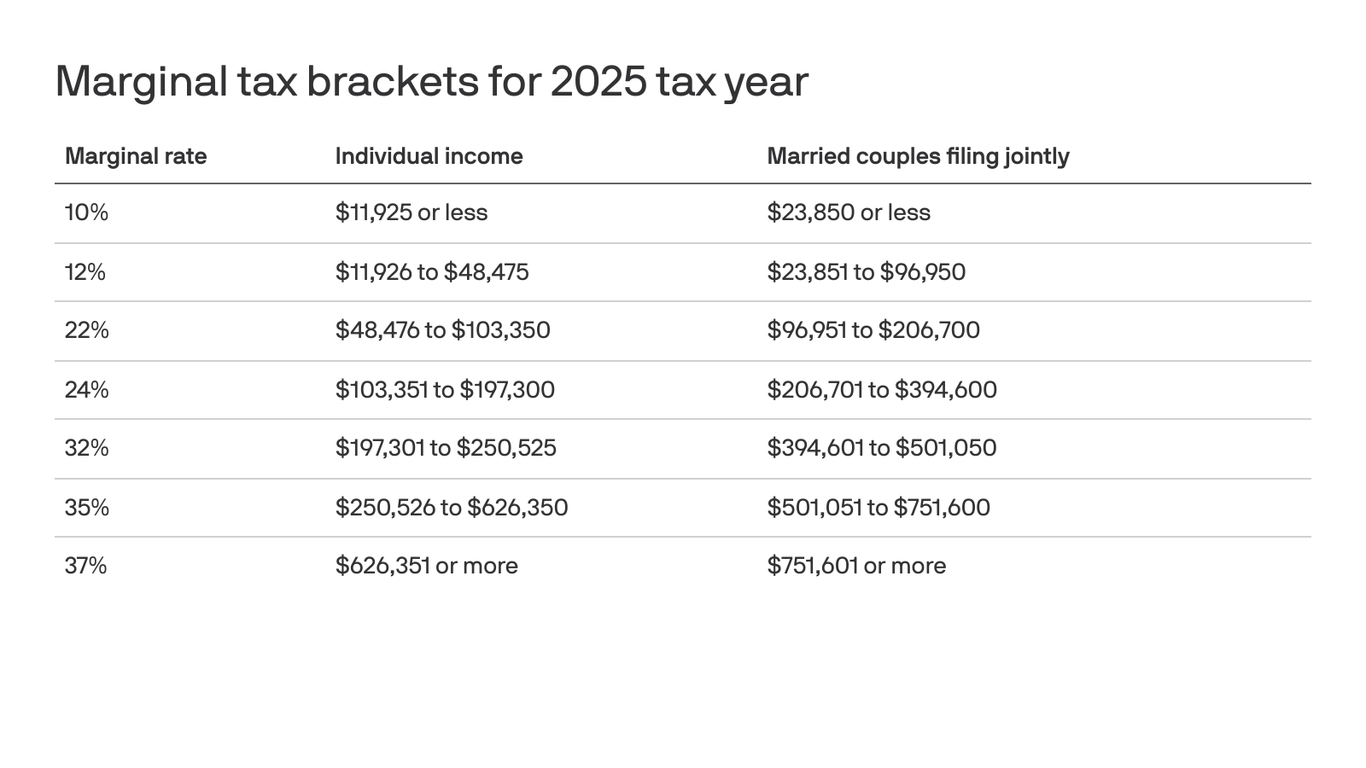

Us Tax Brackets 2025 Chart Free. The tax brackets for 2025 remain the same as the 2025 brackets at 10%, 12%, 22%, 24%, 32%, 35% and 37%. 10 percent, 12 percent, 22 percent, 24 percent, 32.

In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 10%, 12%, 22%, 24%, 32%, 35% and 37%.

2025 Tax Brackets Vs 2025 Side By Side Phil Hamilton, 1.45% for employee and employer over $200,000.

IRS 2025 Tax Rates A Comprehensive Guide To Projected Tax Brackets And, From january 1 to december 31, 2025, the following rates apply:

Marginal Tax Brackets 2025 Vs 2025 Judye Gabriella, The irs recently announced changes to the 2025 tax brackets, something that happens every year around this time.

2025 Tax Brackets Vs 2025 Tax Rates Darlene Clark, 2025 us tax tables with 2025 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

2025 Tax Brackets For Married Filing Jointly Beginning Of Ramadan 2025, Because of the inflation adjustment, the new tax.

2025 Tax Rates Single Irs Virginia Bell, Discover the new federal income tax brackets for 2025, including updates on standard deductions and credits.

Expiration of “Trump” tax cuts Page 2 Money Talk, For 2025, there are seven federal tax rates:

2025 tax brackets IRS releases inflation adjustments, standard deduction, 6.20% for the employee and 6.2% for employer medicare:

Sales Tax By State Chart, That will remain the same for tax year 2025 (filing in 2026), but the irs adjusts the.